By Kelly Asche

Every year the Center publishes the “State of Rural” report – a brief overview of the demographic and economic trends from a rural perspective. This year’s report will be published in December 2021. Over the next few months, we will be writing about some of the trends in the report here on our blog allowing us to dive a bit deeper than we can in the original report.

Education and Health Services Rules Employment in the Aggregate

At an aggregate level, the top employment industries across Minnesota are very similar.

One issue that arises when looking at jobs and employment in rural areas is that many data sources do not capture farm employment due to many of the workers not being covered by typical unemployment insurance programs. The information provided below is a mix of two data sources in an attempt to capture the employment impacts of agriculture. Although mixing two data sources can be problematic, we feel that this more accurately captures the worker-industry environment than just leaving out agriculture altogether. It should also be kept in mind that, as our report on the impact of agriculture on rural Minnesota’s economy shows, a large part of what we think of as agriculture—food processing, non-food processing, commodities trading—is, in reality, an ag-related industry and is categorized into several separate industry sectors, including manufacturing, transportation, and financial.

With this in mind, table 1 provides the top employment industries by Rural-Urban Commuting Area County groups. As you can see, education and health services are the top employment industries no matter how rural or urban a county might be. The other top employment industries that are similar across all county groups include trade, transportation and utilities; leisure and hospitality; and manufacturing. One difference that is a bit more dependent on how rural or urban a place might be is farm employment (higher if more rural) and professional and business services (higher if more urban).

Table 1: 2019 top five employment industries by planning region. Includes percent of total employment in each industry. Data: Bureau of Economic Analysis, Local Area Personal Income and Employment | MN DEED Quarterly Census of Employment and Wages

[table id=8 /]

A Bit More Nuance at the County Level

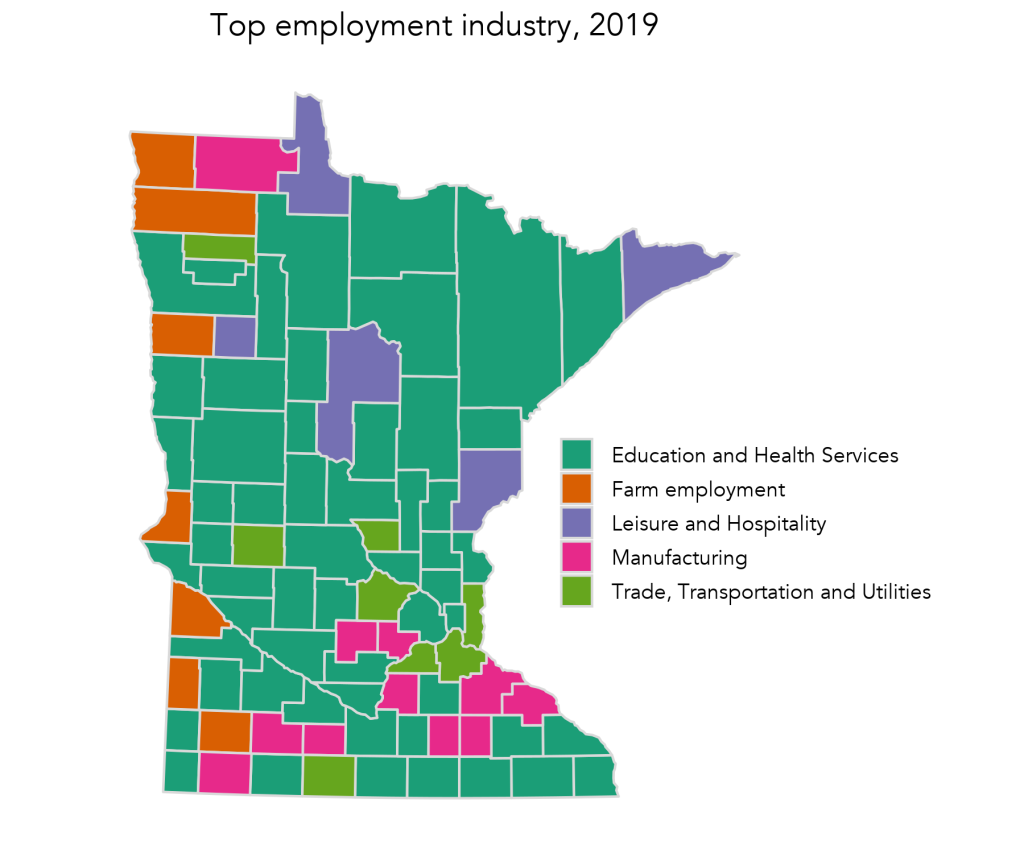

However, there is a bit more nuance outside of the aggregate. Figure 1 provides the top employment industry for each county in 2019. Although education and health services are still the most prominent employment industries across all of Minnesota, there are a few other industries that show up in the top spot. Agriculture becomes more prominent in western Minnesota, leisure and hospitality in a few counties in northern Minnesota, and manufacturing in southern Minnesota (Figure 1).

Figure 1: Education and health services is the dominant industry sector across Minnesota in terms of highest employment. Other industries take the top spot where expected, such as agriculture in western counties and leisure and hospitality in some northern counties. Data: Bureau of Labor Statistics, Quarterly Census of Employment and Wages; Bureau of Economic Analysis, Local Area Personal Income and Employment.

For most of these top employment industries, significant changes are occurring. The health care industry is experiencing significant consolidations and changes to service availability across our communities. Education funding continues to be a source of tension in many school districts. Farming continues to experience a roller coaster in commodity prices while land values continue to increase. And all of these industries are experiencing workforce shortages while also dealing with continued impacts from the pandemic. Policies that attempt to alleviate these issues will sometimes look very different. And the tension that policy-makers must navigate is that these policies may be great for one county while not having much of an impact in another – meaning that the outcomes are location specific but support to pass these policies must span across much of the state in order to pass.

These employment breakdowns help explain why some counties may care more about policy that impact a specific industry more than another. For example, some counties in western Minnesota may care more about policy related to meat cutting programs where it also might be harder to pass a school referendum. The percentage of people engaged with these industries might be very different, leading to different outcomes in support.

Stay tuned for further highlights from our State of Rural report in the coming weeks.