By Phil Jensen

Owning a home outright, or without a mortgage, can relieve strain on a household budget. Households without a monthly housing payment can achieve a higher standard of living with the same earnings, or can get by more easily with lower incomes. For these reasons, outright homeownership can especially impact households with smaller or fixed budgets, including many senior citizens.

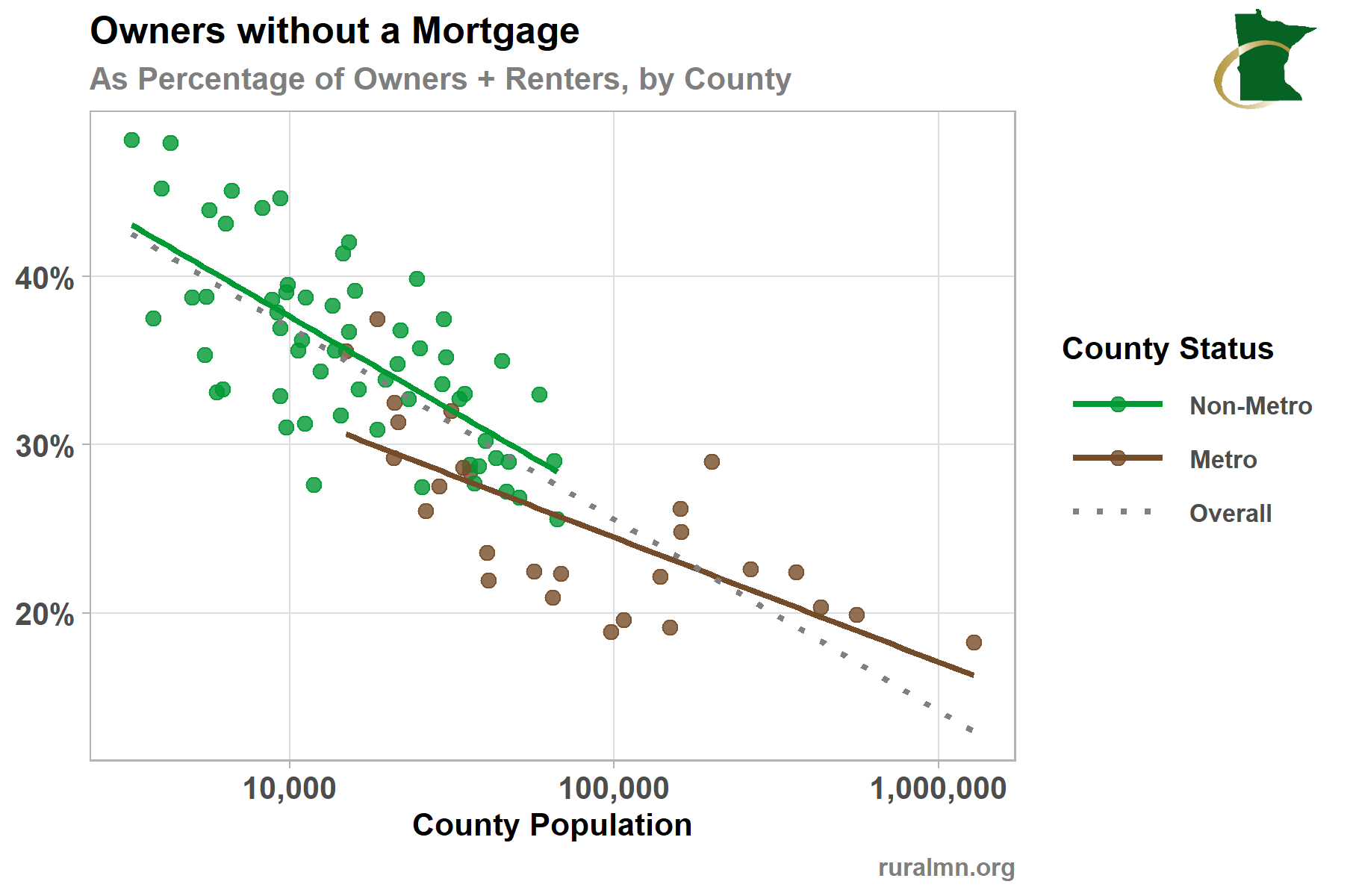

Outright homeownership is more common in rural areas nationwide, and the trend persists among Minnesota’s counties. The figure below shows that, as county population increases, the percentage of households who own a home without a mortgage decreases. (Each dot equals one of the state’s 87 counties.) Across the range from the smallest to largest counties, the rate of homeownership decreases by about half, or by about 30 percentage points (Figure 1).

Figure 1: Outright Owners as Percentage of Owners and Renters, by County. Frequency of owning a home without a mortgage, expressed as a percentage of all households that own (but not rent), decreases as population grows, as well as in metropolitan counties themselves. The slopes of all linear trends shown here are significantly less than zero. Data: U.S. Census Bureau – American Community Survey 2015-2019

This first figure shows the rate of outright ownership among all households that either own or rent. But renting is more common in metropolitan areas, meaning that it’s not an apples-to-apples comparison between metro and non-metro counties. A better comparison is the percentage of homeowners who own outright. Among people who own their homes, are people in rural areas still less likely to have a mortgage?

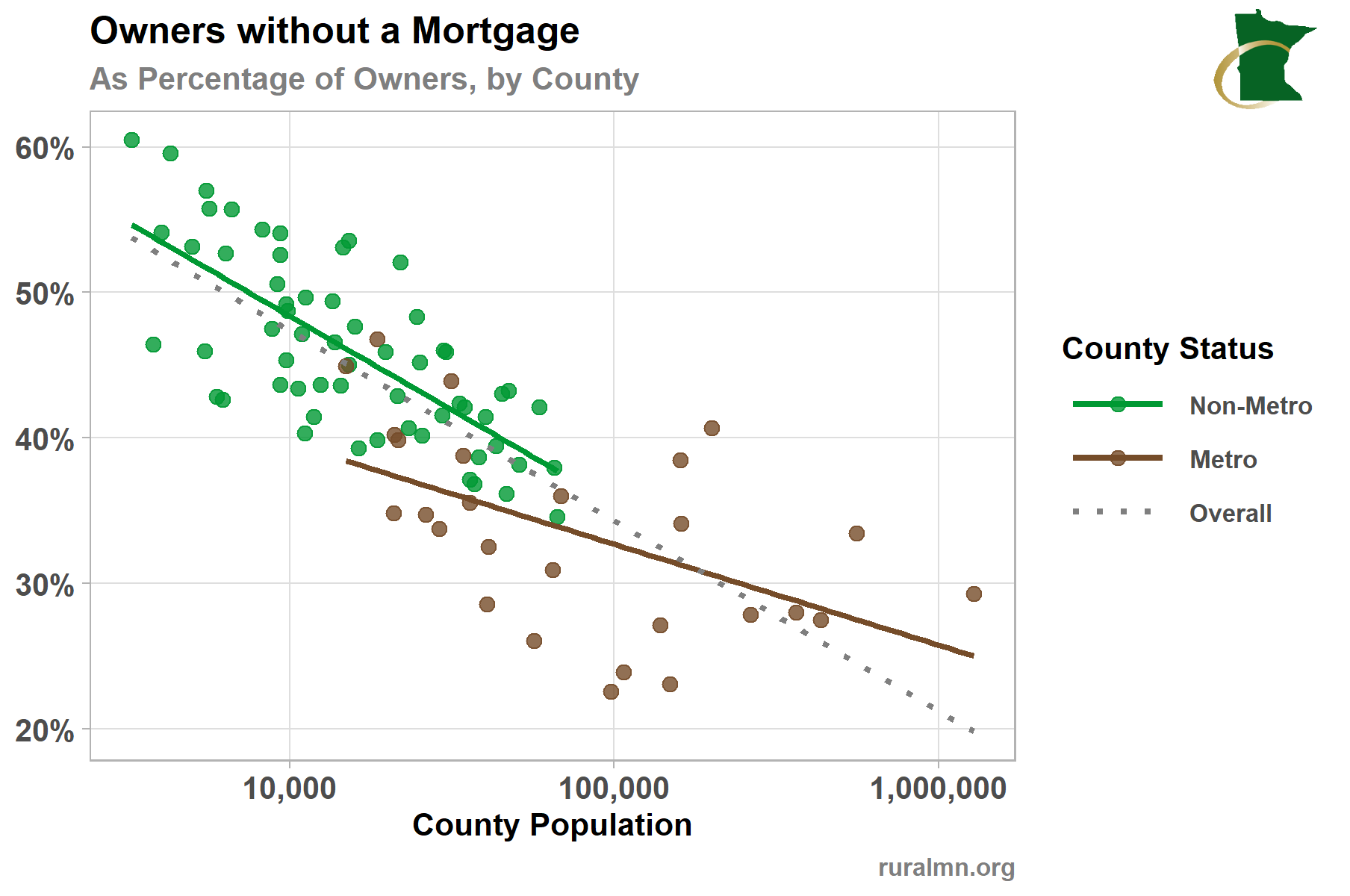

The second figure shows that they are. Like in the first figure, as county population increases, the rate of outright homeownership decreases – again, by about half. Households in rural counties are more likely to own their homes outright, as a percentage both of households in general and of households who own their homes.

Figure 2: Outright Owners as Percentage of Owners, by County. Frequency of owning a home without a mortgage, expressed as a percentage of all households that own (but not rent), decreases as population grows, as well as in metropolitan counties themselves. The slopes of all linear trends shown here are significantly less than zero. Data: U.S. Census Bureau – American Community Survey 2015-2019

This trend probably owes to many factors that influence the ability to pay off a mortgage, including rural residents’ older age and their lower real estate costs. Regardless, the simple fact that more people own their homes outright in rural areas can impact housing policy.

A forthcoming report from CRPD will highlight how rates of homeownership may influence “housing churn,” where residents transition through different types of housing, especially later in their lives. In rural areas, residents who are more likely to own their homes outright – and therefore don’t pay a mortgage or rent – may be less willing to move into other forms of housing, especially if that move may incur additional monthly costs.

That reluctance to move can impact housing initiatives, especially those aimed at expanding housing stock. For example, because they are more likely to own their homes outright, might rural people be less attracted to higher-density housing developments, and therefore less likely to move and free up traditional single-family homes for working families? Would initiatives be better served building housing for working families directly?

The report will be released in the coming weeks. Be sure to watch ruralmn.org or other CRPD marketing for details.

Phil Jensen, PhD, is a freelance data analyst and technical writer. A former professor and college administrator, he has written data-driven reports on topics including education, molecular biology, taxation, and college athletics. Phil is a born-and-raised Minnesotan and lives in Greater Minnesota with his wife and son.