By Marnie Werner & Kelly Asche

While it’s a relief to see something of a time frame on this epidemic, for many businesses, like restaurants and bars, salons, and their employees, end dates weeks out only indicate how much longer they need to be closed. It’s a tough blow, especially in rural areas where it might seem like this is all a lot of fuss and bother. It’s not, as we explained in Monday’s post, so to help cushion the blow to local economies, the state is putting into place several relief programs. The list we’ve included isn’t comprehensive, but it should get anyone who’s interested to a web site where they can find out more.

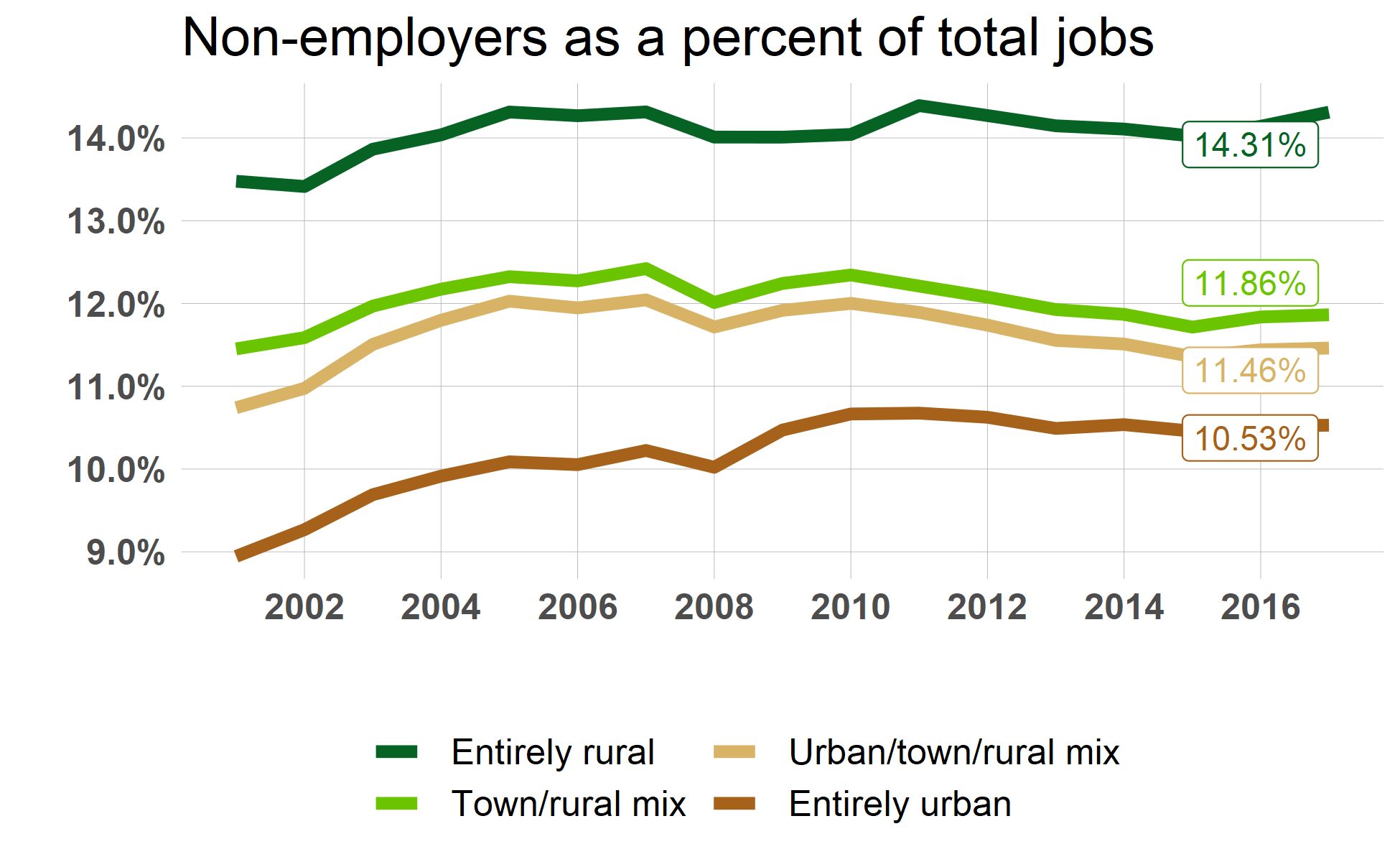

An important question for rural Minnesota is how much small business owners, including non-employers and 1099ers, are being affected and whether they will be eligible for these emergency programs. This is a big issue for rural Minnesota since these types of businesses make up a larger share of the jobs compared to more metro areas (Figure 1).

Figure 1: This chart highlights the larger percentage of jobs made up of self-employed in our more rural counties of the state. Data: U.S. Census Bureau, Non-employer Statistics

It’s important to remember that these programs are evolving every day to meet the needs of people who are impacted by the shutdown. Be sure to let your local legislators and DEED know what issues you are facing. State leadership wants to hear from you and wants to make sure these programs are helping folks that need it.

First off, from the MN Department of Employment and Economic Development:

DEED is in the process of creating a Small Business Emergency Loan Program by making available $30 million from special revenue funds. These dollars will be used by DEED’s lender network to make loans of between $2,500 and $35,000 for qualifying small businesses. The loans will be 50% forgivable and offered at a 0% interest rate. These emergency loans will be made by an existing network of lenders DEED works with across the state. Notably, DEED is asking all small businesses who need loans to apply with the SBA as well, to ensure we’re taking advantage of all the federal dollars available for Minnesota businesses. Applications will open up later this week through their lender network. For more information on the specifics, please visit our COVID-19 hub for businesses.

Eligibility guidelines can be found at DEED’s Small Business Emergency Loans web page. To be eligible, a business must be an existing small business in that it has a “legal structure” (i.e. legal liability entity, corporation, sole proprietorship, or partnership). The details are still being developed, so please follow the DEED web page.

Also from DEED:

Effective immediately, any local unit of government or lending partner with a revolving loan fund that was provided by State Minnesota Investment Fund program appropriations or Minnesota Investment Fund Disaster program appropriations may over the next 90 days issue loans to retail and service providers. Full state guidelines for the use of these funds can be found at the Minnesota Investment Fund page. Local units of government must also follow their individual revolving loan fund guidelines. To determine if funds are available near you, please contact your local government directly.

Here are some links for the business and civic community:

- If you’re a business or a worker who has general questions about how COVID-10 affects business, consult DEED’s COVID-19 Information page.

- If you want to know what state government has to offer businesses so far, check out DEED’s blog on Helping Minnesota Businesses during COVID-19.

- If you’re a small business who needs to take out a disaster loan from the Small Business Administration, learn how to apply here: MN Small businesses NOW eligible for SBA disaster loans

- If you’re a business or a worker who has questions about how unemployment insurance works, consult DEED’s Unemployment Insurance FAQs.

- If you’re going to apply for unemployment benefits, APPLY ONLINE at www.uimn.org. Phone lines are jammed, resulting in long wait times.

- For information on delaying your sales and use tax payments see the MN Dept of Revenue Sales and Use Tax page.

From the U.S. Dept. of Labor’s Wage and Hour Division, Families First Coronavirus Response Act:

The guidance for both employers and employees addresses critical questions such as:

- How does an employer count its number of employees to determine coverage?

- How can small businesses obtain an exemption?

- How does an employer count hours for part-time employees?

- How does an employer calculate wages employees are entitled to under the FFCRA?

The initial WHD guidance is available in three-parts:

From the Small Business Administration:

Minnesota small businesses can also apply for SBA Disaster Loan Assistance, which can provide low-interest loans to businesses and private non-profits. Apply online at the SBA Disaster Loan Assistance site. Economic Injury Disaster Loans may be used to pay fixed debts, payroll, accounts payable and other bills.

From the Internal Revenue Service:

The U.S. Treasury Department, IRS and U.S. Department of Labor announced that small and midsize employers can begin taking advantage of two new refundable payroll tax credits designed to immediately and fully reimburse them for the cost of providing COVID-19 related leave to their employees. Additional guidance, including how to claim the credits in advance, is being prepared and will be posted to the Coronavirus Tax Relief page on IRS.gov as soon as it is available. Please refer to this site with questions or reach out to your local IRS office if you need assistance.

Finally, the Southern Minnesota Initiative Foundation has put together a comprehensive COVID-19 resource page listing agencies and foundations businesses and nonprofits can turn to for assistance during the pandemic. This page will be helpful even you’re not located in the foundation’s region, and if you’re not in SMIF’s, you can check in with one of the other five Minnesota Initiative Foundations located around the state for advice.